Paperless

Digital

On the Cloud

Accounting,Tax & Advisory services

Cloud

Cloud technology is the new poster boy of digitisation. It is at the heart of the digital transformation landscape. Investment in cloud based technologies is a critical first step for all businesses, irrespective of size and scale. Hybrid working through a flexible working approach is the new normal, keeping abreast with new and emerging technologies is the new normal, real-time access to data across all platforms without geographical constraints is the new normal. Cloud is the new normal.

Services

Accounting & Payroll

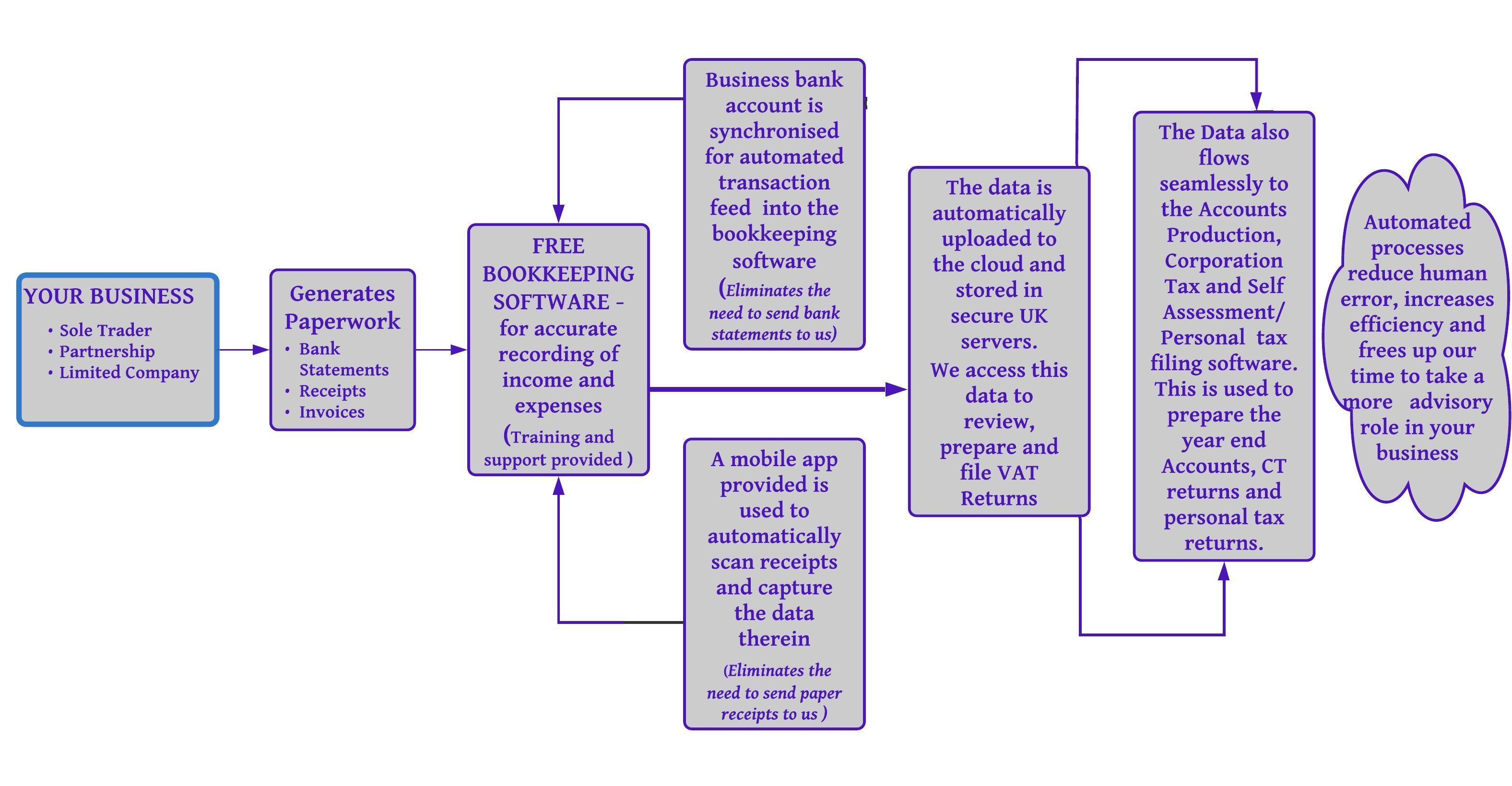

Bookkeeping

We help you integrate your bookkeeping software with our system, if you have one, or we set it up for you to integrate with our MTD compliant, end to end Accounting and payroll system on the Cloud. Your bank data securely feeds into the system in real time. You gain access to a Invoice/Receipt scanning mobile App. You use this to scan your receipts periodically (just like you take photos). The app picks up the data, transmits and updates the system.

VAT

If you are VAT registered, we use the data from (1) to prepare quarterly VAT returns. Upon client confirmation, the return is filed and VAT payment schedule is sent out.

Payroll

Payroll is a particularly emotive area among all of the services. As an employer nothing is more frustrating than having an unhappy employee on pay day with a payslip in hand. Our RTI compliant, easy to use and comprehensive payroll software makes the process simple and accurate. PAYE & Pension figures are sent out along with the payslips with details on when and how to pay them. Joiners and leavers , maternity and paternity pay , pension contributions, changes to payroll are all handled efficiently . Every employee is issued a P45 or a P60.

Statutory Accounts

From the data in our system, the year end accounts are ready for preparation. Additional information are requested, adjustments made and a set of draft annual Accounts are sent out for client review. When required, meetings are scheduled to discuss matters that need further consideration and upon mutual agreement a final set of Accounts are sent out for client approval for filing with HMRC and, where applicable, to Companies House.

Taxation

Corporation Tax

Limited Companies file a Statutory Accounts (which details the Income and Expenses) and a related Corporation Tax Return (which details how much tax it has to pay for the same period) to HMRC. An additional filing is done with Companies House. Like any other tax, this lumpsum tax can be overbearing to business cashflow. Careful planning and up-to-date tax advice on projected outgoings helps mitigate any unexpected surprises.

Self Assessment

This covers all aspects of personal taxation and is an annual filing that details an individual's annual income and related tax liability. This covers both Income tax and Capital Gains tax as well as the complex areas of domicility and tax residency, which can have a significant impact on an individual's tax position, especially those who have lived, worked or have assets overseas. We will help manage all aspects of personal taxation including matters related to investment property income, disposal of shares and properties, share trading income, dividends, PAYE, pensions , VCT & EIS relief .

VAT

VAT rules and regulations constantly evolve and can be a difficult and time consuming process for business owners to invest in. Non compliance in VAT matters is a serious issue and the changes towards MTD has only added a layer of complexity. We will help manage your VAT obligations efficiently and ensure your returns are filed on time and accurately thereby aim to eliminate any surcharges or penalties. We will help with: a) VAT registration b) Assessing the best VAT scheme to use c) VAT for cross border trade d) Preparing and filing VAT returns e) Any matters raised by HMRC and negotiating on your behalf

Tax Planning

Ongoing Pro-active tax planning and advice will be provided to optimise your tax position . For Directors and shareholders of Limited Company, a dividend strategy will be carefully prepared and monitored with an aim to minimize the overall tax liability. Sole traders would be provided detailed advice on the best structure for their business, from a tax perspective. Every client will be advised on the routes available to enjoy additional tax relief to minimize their tax position.

What is 'Making Tax Digital'

"You need to get to the future first, ahead of your customers, and be ready to greet them before they arrive." – Marc Benioff, Founder, CEO, and Chairman of Salesforce

How does this translate in real life?

MTD for VAT is already in place for VAT registered businesses. These businesses need to follow the new rules for MTD which include using dedicated MTD complaint software and maintain a digital record of the VAT filings. Every filing is mapped with a complete set of digital data that can be readily verified.

MTD for Income Tax - From 06th April 2026, self employed businesses and landlords with property income in excess of £50,000 will need to follow the MTD rules for Income tax.

MTD for Corporation Tax - This is still some distance away and will not be mandated until April 2026. The scope and effect of these changes would be widespread and neither businesses, the accounting profession, IT providers or the HMRC is quoite ready yet. Consultations would be the first step to garner opinion and chalk out a roadmap to these changes.

Digicounts uses fully compliant MTD software, will be one step ahead of the next curve and research and invest its efforts to incorporate the best possible technologies to fulfil its aim to take a Digital First approach. Clients would benefit from streamlined processes, time and cost savings, increased efficiency and timely compliance.

“Every industry and every organization will have to transform itself in the next few years. What is coming at us is bigger than the original internet, and you need to understand it, get on board with it, and figure out how to transform your business.” — Tim O’Reilly, Founder & CEO of O’Reilly Media

The Practice

The guiding principles of this Practice are :

- To help those who reach out

- To serve those who trust

I have had the privilege of working in close collaboration with a variety of individuals and Owner Managed Businesses over these years. Some of them had humble beginnings yet have gone on to add substantial value to their businesses. I have seen first hand , the significance of a trusted Client-Accountant relationship. The opportunity to play an important role in the lives of real people, to help in their growth story, and how our words and actions impact their lives, is rewarding and humbling.

I am commercially aware and understand that numbers do not always paint the full picture. With extensive experience with Contractor clients in the IT & Management Consultancy sectors, I understand well the challenges faced by clients due to the changes to the IR35 regulations. Other areas of work include Real estate, Investment Property, Importers from within and outside the EU, Medical Consultants, Building and Construction trade, Retail outlets, Children's Nurseries, Care Homes , Pharmacies, Self employed professionals - the likes of Interior designers, Web developers, Tuition providers, Personal Trainers, Photographers and Videographers. With my years of experience in a specialist Tax practice I gathered an in-depth experience in areas of personal and business taxes for the SME sector and I'm passionately driven by the phrase "You never pay any more tax than you have to".

Digicounts takes a Digital First approach to accounting. Digital First or Digital by Default is essentially a shift away from traditional working methods and focus and prioritise on digital methods above all else. The benefits of this system will be enjoyed by every client and this will make their compliance process simpler giving them time to grow their business and enjoy a fulfilling life. We promise to listen, to collaborate and to help with your statutory obligations.

The role of an Accountant has never been more crucial. The challenges facing us post Brexit and the disruption caused to our lives and livelihood by the Covid pandemic cannot be overstated. With HMRC’s drive to ‘Making Tax Digital’ now taking shape and with the emergence of AI and machine learning , the inevitability of drastic changes to our working lives is upon us. Together, we will embrace this change and together we will prosper.

"When you're finished changing, you're finished." Ben Franklin

Switch to Digital

We do all the legwork to get you onboard

Anti-money laundering (AML)

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (Money Laundering Regulations 2017)and the The Money Laundering and Terrorist Financing (Amendment) Regulations 2019 (Money Laundering Regulations 2019) applies to all individuals and businesses that provide accountancy services, trust and company services or related services such as tax advice, audit or insolvency.

Digicounts Ltd is supervised and regulated by the Institute of Financial Accountants (www.ifa.org.uk) for compliance with Money Laundering Regulations.

Other Information

Contact

- 153 Banstead Road South, Sutton SM2 5LL, UK

- 07791 357356 - Partha Das

+44-7791 357356 - Partha Das

+44-7791 357356 - Partha Das- partha@digicounts.co.uk

- Mon-Sat- 9.00 to 18:30 Out of Hours - Available on WhatsApp

Please feel free to contact me for a free one to one conversation. Alternatively, please drop me an email or a message over WhatsApp. There will be no hard sell or unwanted follow up calls.